Fixed Deposit Interest

Fixed Deposit maturity amount can be calculated using the FD Calculator in a simple manner using the below steps: Customer will have to select the Customer Type i.e. Normal or Senior Citizen; Select the type of Fixed Deposit i.e. Cumulative or Interest Payout (Quarterly/Monthly) or Short Term FD. An FD account is an investment in which the customer deposits a big sum of money, usually starting at RM1,000 and upwards, for a fixed time period. Since you agree to keep the money deposited with the bank for a fixed period of time and are discouraged from. The interest rate for FDs is fixed at the time of opening the deposit and independent of any fluctuations in the market. Some financial institutions even allow one to break their FDs prematurely on paying a certain penalty fee. An FD calculator can be used to determine the interest and the amount that it will accrue at the time of maturity.

- Maximum – 8.50% AYA Time Deposit is ideal for the individual who has excess cash for an extended period of time. The account is opened for a particular fixed period (time) by depositing particular amount (money) and withdrawal is only allowed at the end of the particular period.

- Fixed Deposit Interest Rates In these times of uncertain returns, fixed deposits have become the most preferred banking instruments for planning a financially worry-free future for the family. Which is why Mahindra Finance’s Fixed Deposit scheme has been specially designed to assure you of guaranteed returns at highly competitive interest.

Fixed deposits are term deposits or these deposits are a high interest-bearing deposit and offer a wide range of tenures ranging from 7 days to 10 years. In a Fixed deposit, depositors can deposit the fixed amount for the fixed period in the bank. If the depositor wants to premature the account then the bank charged some penalty. Banks pay higher interest rates on longer-term deposits.

At the time of maturity there are five types of options available for calculating the maturity amount.

- When Principal and the interest are redeemed at the time maturity

Suppose Ramesh wants to open the fixed deposit amounting Rs.5,00,000/- for 1 year and he wants to redeem all the amount at maturity. Then what will be the total amount credited in Ramesh account at the time of maturity? Rate of interest assumed as 7% p.a

Rs.5,00,000 *7%=Rs 35,000/-

Total amount at the time of Maturity is Rs.5,00,000+ Rs.35,000=Rs.5,35,000/-

- FD booked with Quarterly Payout.

When your Fixed Deposit is booked with the quarterly interest payout option, the maturity amount is the same as the principal amount. The interest amount will be credited to your account at quarterly intervals.

Example for Quartley PAyout:

Suppose Ramesh wants a Fixed deposit of Rs. 5000 for 1 year with Quarterly Interest payout assuming the rate of interest @7%p.a.In quarterly interest payout, Interest is calculated on monthly basis and credited to the customer account on every quarter. In this example, interest on Rs 5000 is calculated every month @5000*7%*30/365=28.69. Then add the three months interset 28.69+29.64+28.69=Rs.87 is credited to the customer account in first quarter and so on.

The Total Interest amount is Rs.349/- and the quarterly interest will be credited to the Ramesh account. At the time of Maturity, the Principal amount will be credited to his account.

- FD booked with Monthly Payout:

With Reference to the first example, the monthly interest will be credited to the customer account and the Principal Amount will be created at the time of maturity.Monthly interest i.e. Rs.5000@7%*30/365=Rs.28.69.Rounded off (Rs.29/-) credited to customer account every month and the principal amount Rs.5000/- credited at the time of maturity.

- Short Term Fixed Deposits

A Person can open the short term fixed deposits for a period of 7days to 10 years. At the time of maturity, the principal amount will be credited with the interest in the account.

Suppose Rs.5000 is deposited for a period of 60 days and the rate of the interest is 7% p.a. Interest amount will be calculated as follows:

The total amount credited at the time of maturity is Rs. 5057/-

- FD Booked with Reinvestment or Cumulative Fixed deposit

In a cumulative fixed deposit, interest is reinvested with the principal amount and compounded as per the time period mentioned. The maturity of these fixed deposits ranges from six months to 10 years.

Suppose Rs.5000/- is deposited for 2 years with the reinvestment.ROI @7% p.a.In cumulative Fixed deposit, Interest is calculated on monthly basis and added to the principal amount on every quarter. In the first quarter the interest for three months amounts Rs.76 credited to the principal amount and then in next quarter interest is calculated on Rs.5000+76=Rs.5076/- and so on.

The total amount credited at the time of maturity is Rs.5647/-

- The amount mentioned in the example is an indicative figure.

- Please refer to the FD Calculator to get the exact maturity amount.

Premature FD

As per the Terms & Conditions of Fixed Deposit Accounts of the bank, the penalty on premature closure of Fixed Deposits, including sweep-in and partial closures, has been fixed by the Bank at the rate of 1% of the fixed deposit interest rate. This is applicable with effect from 24th January 2011.

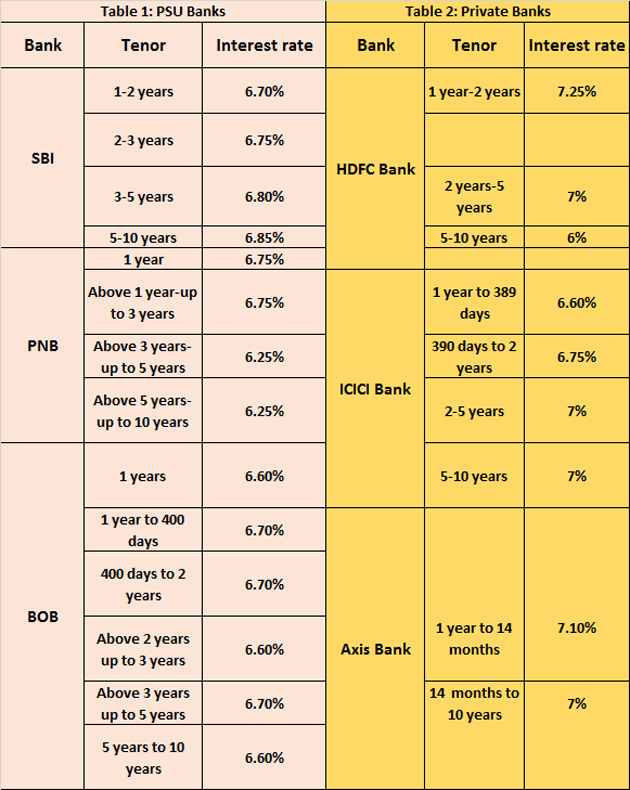

Fixed Deposit Interest In India

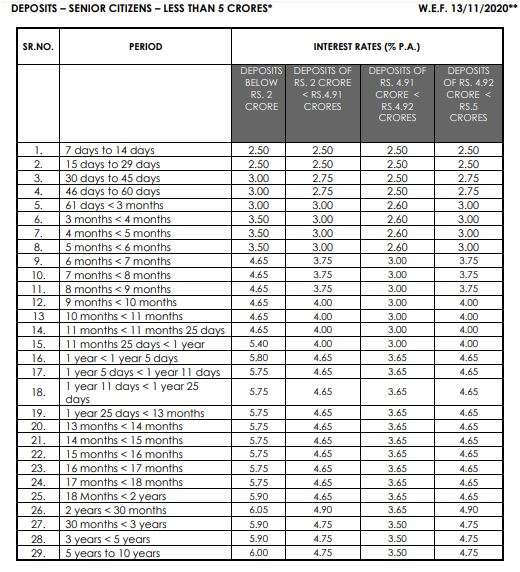

Senior Citizen Interest Rate.

Bank will give a 0.5% extra interest rate to the senior citizen customer of the bank.

Other Related Posts

- What is SIP?SIP means Systematic Investment Plan. SIP gives investors the liberty to invest in a scheme on a monthly basis with a little as Rs.500 per month like bank RD.Every month fresh units are brought with the monthly payments of the investor at prevailimg NAVof the day at the date chosen by the investorsay 5th of…

- Various Options for Investments In IndiaInvestment: Investment means when we earn money and that earned money is partly spent and rest saved for meeting future expenses. Instead of keeping the savings idle you may like to use savings in order to get returns or interest on it in the future. This is called investment. One needs to invest to; Earn…

- what is P/B ratio ?This is one of the frequently used parameter used by investors in share market. P/B means price to book ratio means how much price of that share is when compared to book value of that share . Book value of a share = total assets – total liabilities Price in this ratio is considered as…

- What is Dividend?The term “Dividend” refers to that portion of profits which a company distributes among the shareholders. It is a reward given by the company to its shareholders in lieu of their investment in shares. A company’s dividend is decided by its board of directors and it requires the shareholders’ approval. However, it is not obligatory…

- What is Positive Pay for cheque Truncation systemOn Aug 2020, RBI had asked all the banks to put in place the positive pay system for cheques payments above Rs.50000 to enhance safety and to eliminate the possibility of bank frauds, especially via cheque payments. According to RBI data from April to Sept 2020 bank frauds worth over 64000 crores were reported and…

Investment Amount

Minimum – 10,000MMK

Maximum – No Maximum Limit

AYA Time Deposit is ideal for the individual who has excess cash for an extended period of time. The account is opened for a particular fixed period (time) by depositing particular amount (money) and withdrawal is only allowed at the end of the particular period.

BENEFITS

- Extremely safe

- Higher Interest Rate

- Guaranteed returns

- Fixed Deposit may be pledged to the bank for loans

- Choose the scheme you want

ELIGIBLITY

Anyone who is Myanmar citizen and over 18 years can open AYA Time Deposit account.

Fixed Deposit Interest Rates In Us

- Individual or Joint

- Public Company Limited

- Sole Proprietorship/ Private Company Limited

- Joint venture

- Corporation

- Non Profit Corporation

Keep Your Documents Ready…

Individual

- NRC Number

Corporate

- NRC Number of the authorized person

- BOD Resolution (Meeting minutes)

- Form -6, Form -26, Form E

- Certificate of Incorporation

- Business License

- Memorandum and Articles Of Association

- Export/Import License

INTEREST RATES AND PERIODS

You may choose the convenient period of Time Deposit to gain interest.

- 1 Month Time Deposit – 7.00% P.A

- 3 Months Time Deposit – 7.25% P.A

- 6 Months Time Deposit – 7.50% P.A

- 9 Months Time Deposit – 7.75% P.A

- 12 Months Time Deposit – 8.00% P.A

- 24 Months Time Deposit – 8.50% P.A