Union Bank Of India Interest Rates On Saving Account

- Union Bank Of India Interest Rates On Saving Accounts

- Credit Union Interest Rates Savings

- Which Indian Bank Give More Interest On Saving Account

- Union Bank Savings Rates Today

| You are here : | Products International NRO Savings Bank Account |

Union Bank Of India Interest Rates On Saving Accounts

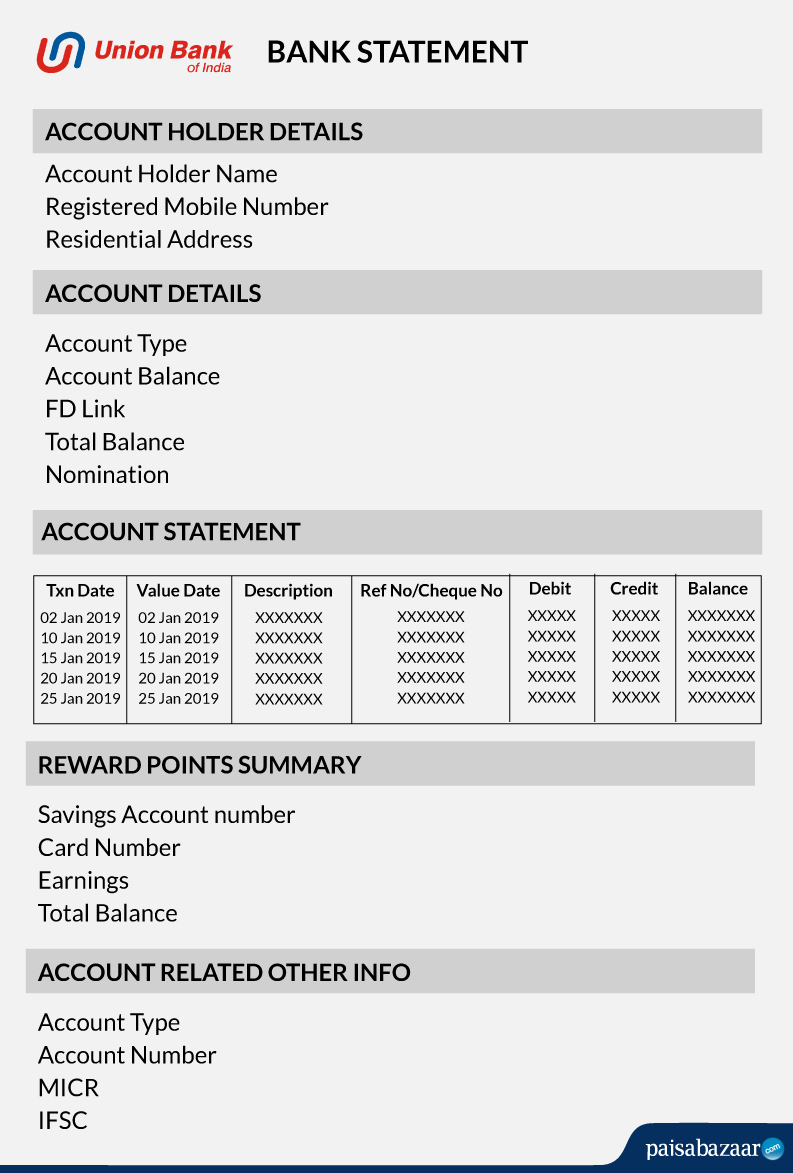

In Union Bank Of India Fixed Deposit account, a fixed sum of money is deposited for fixed tenure usually for a period from 7 days to 10 years. A higher interest rate is offered on fixed deposits which vary from bank to bank according to the amount deposited and duration of investment. For instance, Union Bank of India SCSS interest rate as on September 15th, 2020, is 7.4%. So the deposits that are made now will generate interest at the rate of 7.4% till September 2025. Under Union Bank of India Senior Citizen Savings Scheme, the interest will be paid out on a quarterly basis. Interest is calculated on daily product basis and is credited on quarterly basis in the months of April, July, October and January every year. Saving Bank deposits rates w.e.f. On balance upto & including Rs.

NRO SAVINGS ACCOUNT

Account Type | NRO Savings Bank Account(NRO SB) |

Type of Accounts | Savings Deposit |

Opening of Accounts/Sources of Funding The Accounts |

Caution:: |

ROI | Rate of interest applicable to these accounts and guidelines |

Who Can Open | Any Person resident outside India(as per regulation 2 of FEMA),may open NRO account with an authorized dealer or an authorized bank for the purpose of putting through bonafide transactions dominated in Rupees, not involving any violation of the provision of the FEMA rules, regulations made there under. Opening of accounts by individual/entities of Bangladesh/Pakistan nationality/ownership requires prior approval from RBI. |

Tax on Interest Income | Tax will be deducted as per guidelines |

Loan Facility | Available |

ATM Cash Withdrawal Limit | Rs. 25,000/- per day |

ATM POS Limit | Rs.50,000/- per day |

Personalized cheque Leaves | 40 leaves per year FREE |

- Apply Online

- NRI Deposits

Credit Union Interest Rates Savings

Features:

Features:Which Indian Bank Give More Interest On Saving Account

Any Resident Individual - Single Accounts, Two or more individuals in Joint Accounts, Illiterate Persons, Visually Impaired persons, Purdanasheen Ladies, Minors, Associations, Clubs, Societies, etc.

Union Bank Savings Rates Today

- Minimum balance requirement with or without cheque book facility:

Centres

Without Cheque Book (`)

With Cheque Book (`)

Metro

500

1000

Urban

500

1000

Semi Urban

250

500

Rural

100

250

- Interest is calculated on daily product basis and will be credited on quarterly basis in the months of April, July, October and January every year.

- Rate of interest upto 25Lacs and more than 25 lacs-3%p.a