Deposit Check At Atm

Please turn on JavaScript in your browser

- Can You Deposit Check At Atm

- Deposit Check At Atm Chase

- Deposit Check At Atm Chime

- Deposit Check At Atm Near Me

Don’t Try to Deposit Through an ATM. When you sign a check over to someone else, make sure they don’t try to deposit it through an ATM because you can't guarantee that it'll clear. Feb 04, 2020 Chase Bank ATM Check Deposit. Posting and clearing times for checks deposited at the ATM are different at every bank but understanding how the process works can give you a better idea of when you.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase QuickDeposit℠

Deposit checks with the Chase Mobile® app.

- Overview

- Getting started

- FAQs

- Resources

Use Chase QuickDeposit℠ on the Chase Mobile® app to deposit your checks and access your funds quickly.

Save a trip to the branch and deposit checks on your schedule, virtually anytime and anywhere.

Deposit checks securely from your mobile phone or tablet. We protect your information and never store your passwords or check deposit data and images on your mobile device.

How to get started

Watch how it works with this helpful how-to video.

Choose 'Deposit checks' in the navigation menu of your Chase Mobile® app and choose the account.

Enter the check amount and tap 'Front'. With our new 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually.

Confirm the details, submit and you're done.

Common questions answered

How does Chase QuickDeposit℠ work?

expandIn the Chase Mobile® app, choose “Deposit Checks” in the navigation menu and select the account. Enter the amount of the check and tap 'Front'. With our 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually. Verify your information and submit your deposit. After you submit, you can deposit another check or view the receipt. You’ll get an email when your deposit is received — and another when it’s accepted. If the deposit is rejected, you’ll also get an emailed explanation. Remember to properly endorse the back of the check with your signature and 'For electronic deposit only at Chase.'

When will my funds be available?

expandDeposits submitted before 11 PM Eastern time on a business day generally will be available by the next business day. Deposits submitted after 11 PM or on a non-business day will be processed the next business day. However, we may delay availability if we require further review of the deposit. Any information about delayed availability will be provided in the Secure Message Center, which is accessible in the main navigation menu.

What should I do with my check(s) after I’ve deposited it?

expandAfter you complete your transaction, write “deposited” and the date of deposit on the face of the check. Please retain the marked check for two business days or until you receive our notification that your QuickDeposit has been accepted. After that time, you may destroy it.

Have more questions?

24/7 access to deposit funds

- Chase QuickDeposit℠ — Securely deposit checks from almost anywhere.

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs.

- Direct deposit — Automatically deposit paychecks.

Pay bills quickly & conveniently

- Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Chase QuickPay® with Zelle® — Send and receive money from almost anyone with just a mobile number or email address.

Helpful technology that saves you time and keeps you in the know

- Paperless statements — Digitally access up to 7 years of statements.

- Account alerts — Monitor finances, avoid overdrafts and more.

- Chase text banking — Check balances and transaction history with a text.

Advertiser Disclosure

Advertiser DisclosureWe think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

It takes just a few simple steps to deposit your check at your bank branch or credit union, an ATM, or via your mobile device.

Been handed a check and you’re not sure what to do with it? You can transform that little piece of paper into spending money by either cashing your check or depositing it into a bank account.

If you’d prefer to deposit the funds into a bank account, you’ve got a few options depending on the options available from your bank or credit union. You can go the more traditional route: visiting a physical bank or credit union branch, or stopping by an ATM. Or if you’d rather avoid the extra errand, you may be able to use a mobile banking app on your smartphone or tablet to deposit your check electronically.

Can I deposit part of my check and cash the rest?

Yes, as long as your bank or credit union allows it. When you deposit your check, you can ask your teller to give you cash for part of the check amount and deposit the rest.

At the bank

When you deposit a check in person, you’ll be required to endorse the check, which means signing it. It’s pretty simple: On the back of the check, you’ll find two gray lines with a note saying something like “endorse here.” Sign the check on the top line after you’ve arrived at the bank.

In order to complete the transaction, your teller will make sure the check is written out correctly, and may request to see your identification. You’ll also need to provide the account number or account information for the account you want to deposit the check to.

The whole transaction shouldn’t take more than a few minutes, but you’ll have to complete it during banking hours, which often exclude evenings and weekends. You may also want to plan for a possible wait time at the bank.

Once your transaction is complete, typically allow up to two business days before expecting the funds to be available in your account. A portion or all of your check, up to $200, may be funded by the next business day.

Why does the bank place deposits on hold?

A deposit hold is a period of time, usually around two business days, when the bank holds the funds you deposited by check. This delay may seem unnecessary, but it can actually help you. It helps prevent you from spending the money and then having to repay that money if the check turns out to be fraudulent or had to be returned.

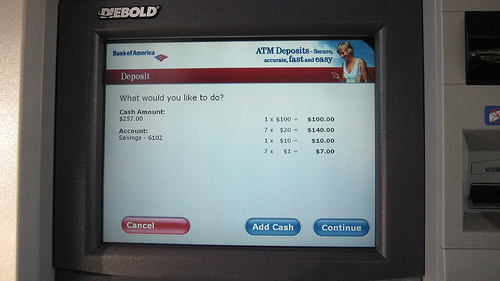

At an ATM

Depending on your bank or credit union, and the type of ATM, you may be able to deposit your check at an ATM. Just like when you visit a branch, you’ll need to start at an ATM by endorsing the back of the check.

Then you can use your bank-issued debit card to access your account info, follow the prompts for a check deposit, and submit your check directly into the designated slot.

Unlike visiting a bank branch, you can deposit a check into any ATM at any time, as long as the ATM accepts checks. Just like when visiting your branch though, you may still have to wait around two business days before having access to all the funds depending on the amount of the check. In fact, it may take even longer if you deposit the check at an ATM your bank or credit union doesn’t own.

Can You Deposit Check At Atm

For that reason, it can be beneficial to visit an ATM owned by your bank. Staying in your bank’s network can also be a better choice because it may save you money on ATM fees.

With your mobile device

If you’ve got a smartphone or a tablet, and your bank offers the option, you can deposit a check using your mobile banking app, nearly any time and any place. Start by logging into the app, locating the deposit option, and choosing which account you want to deposit the check into.

Deposit Check At Atm Chase

You’ll probably be asked to take a photo of both sides of your check. If you’re not successful at using the camera right away, helpful hints may pop up on the screen or you may have access to a chat assistant. You may find it easier if you follow these tips.

- Take the photo in a well-lit area

- Place the check on top of a contrasting (dark) surface

- Make sure all four corners of the check can be seen in the frame

Once you’ve taken the photos, be sure to follow any further instructions to complete the deposit. Then review your account activity to make sure the deposited check appears.

Deposit Check At Atm Chime

Banks may have different time frames for processing mobile deposits — some can be completed as quickly as one business day. But even if the funds from your deposit become available right away, you’ll want to keep the actual paper check for 30 days in case any issues arise with processing. Some banks recommend destroying the check after that.

Bottom line

Regardless of how you choose to deposit your check, be sure to do it right away. There’s no strict rule about when checks expire, but many banks won’t accept a check that’s more than six months past its given date. Plus the longer a check is sitting around, the more likely it could be lost or stolen.

Deposit Check At Atm Near Me

For payments you receive regularly, like your paycheck or other regular check disbursements, consider setting up direct deposit. This paperless option automatically deposits your payments into your account, freeing you up from having to deposit the check yourself. As an added bonus, many banks make payroll funds deposited by direct deposit available immediately.